The FTX "Crypto-Central Bank" Operation

When insatiable greed overcomes fear, disaster is certain

Everyone is talking about the FTX cryptocurrency failure and bankruptcy — FTX alone will be bigger than Enron ($50B vs $23B). In a complete coincidence, I’m sure (/sarc), the gentleman who cleaned up Enron will be cleaning up the FTX trainwreck, as well. Many people lost their money in FTX and other related company failures, over 100 other firms have declared bankruptcy because of FTX. How did this happen, who caused it and who benefited from FTX and this debacle? FTX and the other crypto exchanges and coins must fail or be regulated into a box and the digital passport and wallet will be released before the Central Bank Digital Currency is launched.

In this article, I will demonstrate that FTX was a project of central banking, deep state actors and it was likely loaded with CCP plants. The purpose of FTX was to be a money laundry for the WEF New World Order, to bribe politicians, and eventually to massively fail, leading people away from crypto and into the hands of the only “safe and legal” crypto, the Central Bank Digital Currency. “Only our bank is safe.” is their motto.

Building an exchange is not easy, it requires a lot of capital and experienced people… “fit and proper” is the terminology of qualification of banking in Liechtenstein, where I attempted to setup an exchange. The staff must be qualified people with a decade or more experience in working at banks and in banking compliance and you will immediately notice that FTX did not have people with this level of experience and in my opinion, this caused the failure.

I also personally know people who founded crypto exchanges; one crypto trading platform had three founders and their profit distribution for just one year was $500m each — this was a straight up exchange that didn’t trade exotic options or derivatives and never used leverage or fractional reserve and it wasn’t the biggest. When you can make this kind of money on transaction fees, why take any unnecessary risks? Exchanges can be wickedly profitable, like a casino, insurance company or bank and that is exactly why FTX was created. FTX was using the winnings to help fund their political agenda and buy favors from politicians — it would then get regulation passed to give FTX a legal monopoly.

The Biggest Power Brokers Helped FTX from the Start

Sam at a conference with “sponsors” Tony and Bill.

FTX had the sponsorship of the biggest names in politics and banking and partnerships with the WEF and others. They spread the wealth to be sure anyone important had an interest in their success, regardless of political party, though most funding went to liberal Democratic party causes.

FTX was a partner of WEF. This web page signaled Cult support of FTX; it has been removed from the internet. (screenshot)

In my understanding, the goal of FTX was to become a registered legal monopoly for custody and trading of crypto, similar to DTCC and Cede and Co. for publicly traded shares. As Wikipedia says “Cede technically owns all of the publicly issued stock in the United States.[2] Thus, investors do not themselves hold direct property rights in stock, but rather have contractual rights that are part of a chain of contractual rights involving Cede.” This was the goal of FTX. To literally own all the crypto in the world — they would use regulation and the power of their new friends in government and banking to accomplish that.

Remember: “You will own nothing and be happy”.

Ukraine was also a connection to FTX; crypto donations were accepted by an account at FTX and forwarded on to the central bank (National Bank of Ukraine). There have been speculation and memes about the ~$100B of funds sent from the US Congress to Ukraine ending up in politicians pockets and PACs — there is no proof (yet, let’s see if the “life insurance” customer list shows up) that Ukraine funds provided by the US round tripped through FTX. However, U.S. politicians have provably taken funds for their PAC’s from Sam and FTX. Sam was the #2 donor to Democrat political orgs only after George Soros:

There were also many donations from the FTX.US foundation, again #2 to Soros:

Some donations were made to Republican oriented PACs as well, including one linked to Sen. Mitch McConnell. From USSAnews.com:

The now bankrupt cryptocurrency exchange FTX donated $2.5 million to the McConnell-influenced Senate Leadership Fund, a super PAC that withheld funding from or attacked a handful of America First, “MAGA” candidates for U.S. Senate. While the Senate Leadership Fund opted to cancel a critical $9 million in ads supporting Blake Masters in Arizona, it did donate to senators who voted to impeach former President Trump. A similar story played out in the U.S. House of Representatives, where soon to be House Speaker Kevin McCarthy (R-CA) used FTX funds to attack MAGA candidates in Republican Party primaries.

The Senate Leadership fund received $2.5 million from FTX for the 2021-22 cycle, according to records at Open Secrets. Also, this:

Another recipient of funds was a study designed to bash ivermectin as an early treatment for COVID, helping pave the way for the Emergency Use Authorization of the vaxx. The COVID operation intersected with FTX, the money connected them all.

Why an Exchange Was Used for the Operation

Exchanges are the keystone to the crypto environment and bitcoin (BTC) is the key currency — they are the nexus in the crypto eco-system because they attract high traffic and generate large profits. One goal is to normalize the public to using digital currencies, another is to set up central storage of digital currencies. I’ve written before that I believe BTC was a security agency operation. Crypto currencies are promoted through market making (someone effectively sponsors the coin) to drive increasing value and greater ownership and utility for a coin. Increasing price and utility become a self-fulfilling prophecy, as long as the price goes up.

While BTC is the king, USD stable coin Tether (USDT) and exchange coins (such as FTX’s own FTT token) play key roles. Exchanges take your crypto coins and place them in a common wallet with keys controlled by the exchange. A ledger of ownership is maintained by the exchange. When you are done trading, you can withdraw your coins from the exchange and put them in your wallet, where you control the keys. People are lazy and let the exchange wallet to store their coins, because they don’t need to pay close attention….until the exchange gets hacked, makes bad loans or goes belly up and withdrawals are stopped. This is caused by not having the funds in the exchange to back withdrawals. Exactly like a failed bank, the fraud happens when the money leaves the bank. Always follow the money!

Here are two noteworthy crypto exchange failures that I believe show the exchange controlled demolition model being used:

-MtGox - the largest BTC exchange at the time got hacked in 2011, losing substantial customer funds. What was left went through bankruptcy where the accountants and lawyers got their pound of flesh. Some of the BTC may have been used to suppress the price in a later operation. Customers are still waiting for repayment, over ten years later! This story details the latest customer repayment information.

-Cryptopia - the most popular exchange for alt coins, based in New Zealand was also hacked in 2019. The failure of this exchange caused many of the smaller alt coins to also fail.

These previous failures were caused by “hacks”, which are almost always inside jobs. After disclosure of the hacks, the exchanges were shuttered and placed into bankruptcy liquidation. Remaining coins were seized by the local authorities and might eventually have a portion return to their owner after a long period of time, not unlike an extended “lockup”. Any unclaimed assets are “escheated” to the local government (yes, the word “cheat” is right inside) and they benefit from the “hack”.

FTX was structured as an exchange that mimicked central banking with the issuance of its own house tokens called FTT, which were lent out, circulated and were “pumped” to increase perceived value and then borrowed against with real assets to further leverage the flywheel. FTT and Tether were what powered the pump of BTC to almost $68,000, attracting one million customers. It was a model that is familiar to students of central banking:

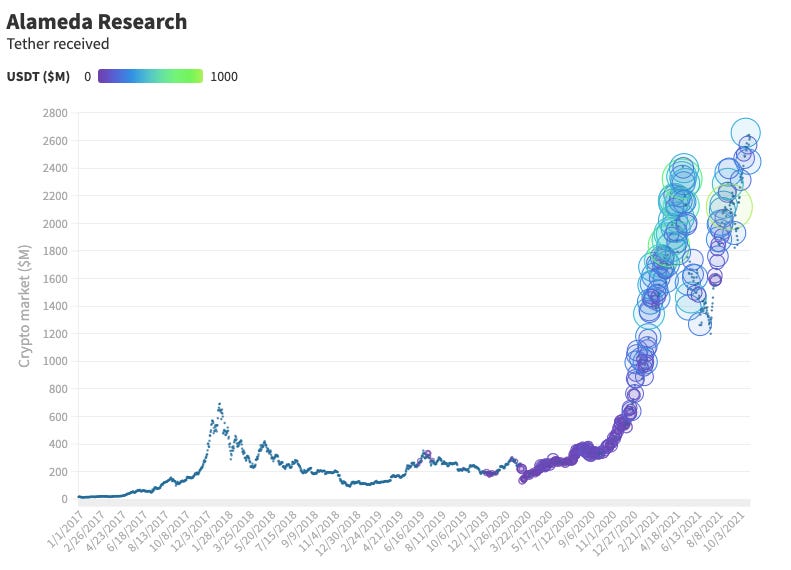

The FTT coins are then pumped using USDT (Tether, USD backed) to bid up the price of FTT. Alameda Research, the associated trading firm was the recipient of almost $37B of Tether, just under 40% of the Tether sent during that time.

Tether is likely to be the next crypto disaster. Tether is the third largest cryptocurrency, exceeded in market cap only by ETH (Etherium) and BTC (Bitcoin). Because it is supposed to be pegged to the USD 1:1, you are supposed to be able to redeem it for cash money. If for some reason redemptions are closed, which could be due to a banking problem, regulatory issue or technical blockchain problem, you could see a run on the coin, the same as what happened to FTT. How much cash is actually in the bank to back up Tether? Don’t ask the auditors, they change annually. Keep your eye on Tether.

Also, FTX spent lavishly on celebrity promotion with ad spots from Tom Brady, Steph Curry and Larry David, as well as a $135m naming rights deal with Miami Heat stadium.

FTX Began with Arbitrage

FTX got its start arbitraging BTC for USD in Japan and Korea, where banking regulations restrict remittances out of those countries and BTC trades for a premium over other places. As an example, if you can buy a BTC in the USA or EU for $20,000, but sell it in Korea or Japan for $21,000, there is an arbitrage profit potential. However, the wrinkle is you need to bring funds out from the bank account in Korea or Japan, but those funds can’t leave those countries easily. To make this work, you need a “special” bank account without these restrictions or a massive pile of capital. I know this because I tried to pull this off myself. The right introductions to the central bank of those countries by a powerful and influential person might do the trick and this is what I believe happened. Only someone “sponsored” by the right people could pull it off, a couple phone calls, the right “red envelope”, and you have your bank account. Sam and Caroline’s parents are connected to the top of the political party in power in the US (Democrats) and a few of the right phone calls will get results. Without the right “sponsor”, you won’t be getting a bank account. This arbitrage generated $1m per day in profits for FTX, a tidy sum to get the ball rolling.

This arbitrage worked because FTX was able to get a bank account that could remit funds out of the restricted country.

To attract retail customers to the exchange and Alameda, the bait was “staking” with a 15% promised return “with no risk”. Common sense says there is no way that kind of return is sustainable without gambling with customer funds. It did not end well.

Sam and Caroline, the Patsies

The frontman and woman for FTX were Sam Bankman-Fried and Caroline Ellison. He is the son of Barbara Fried and Joseph Bankman, both professors at Stanford Law School (per Wikipedia). She is the daughter of Glenn Ellison and Sara Fisher Ellison, both professors at MIT. Here’s Sam, explaining how they scammed people:

Here’s Caroline, in her own words, describing how she is comfortable with risk:

And then there is this gem:

FTX Was on Track to Become a Regulated Crypto Exchange Monopoly

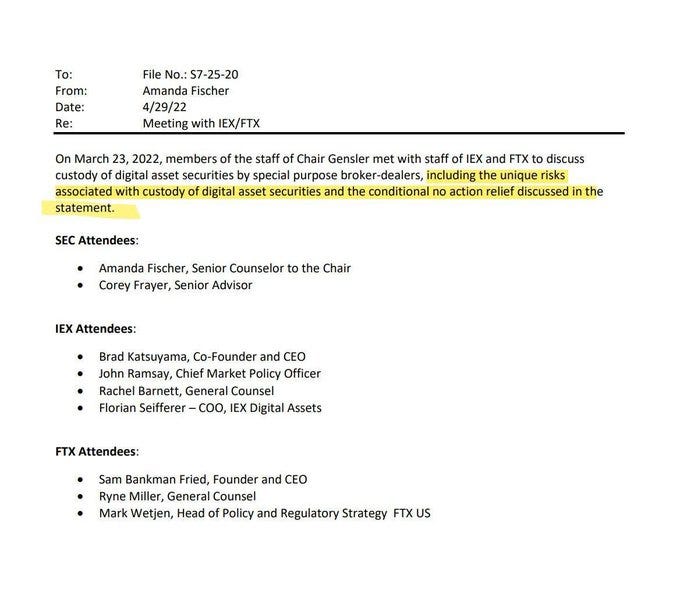

FTX spent substantial time working the regulatory angles, attracting the right investors like Sequoia and Goldman Sachs, donating to the right people in congress and landing the biggest and best meetings a fintech startup could dream of with people like the head of the US Federal Reserve Bank. Meetings were held with CFTC, SEC and the Federal Reserve. Just getting high level meetings like this is out of the ordinary. A few well placed phone calls “get things done” and a conditional “no action relief” document from the SEC would be incredibly valuable to FTX, as this email shows.

The capper was an in person meeting with Jerome Powell, head of the Federal Reserve Bank, during a time when most meetings were virtual video conferences.

Structuring the company to take advantage of the regulations they are helping draft has a good chance of creating an insurmountable barrier of entry, especially when you have the ear of the head of the Fed and the SEC.

The Big Crime was Stealing the Election, not Crypto-Fraud

Sam’s mother, Barbara Fried, is the key person here, hidden in plain sight. She created “Mind the Gap” a 501c3 non-profit PAC, created to influence the 2020 and 2022 elections by distributing partially completed ballots (according to this source), 15 million of them!!!

No one in November 2022 is mentioning SBF’s election-stealing criminal MOM.

How is Barbara Bankman Fried breaking the law by mailing 15 million partially completed ballots to steal our elections?

IRS laws state:

“The IRS permits 501(c)(3) nonprofits to conduct nonpartisan voter registration drives, but not registration drives that have the effect of favoring one party over another.”

Barbara is a founder of the Center for Voter Information and other get-out-the-vote (GOTV) organizations

The Center for Voter information was “founded to provide resources and tools to help voting-eligible citizens register and vote in upcoming elections.”

Barbara’s organization works closely with their nonpartisan and charitable “sister” organization the Voter Participation Center (VPC).

Influence Watch reports that after mail-in voting was ushered in due to Covid-19 in 2020, these two organizations “sent out millions of mailers to battleground states, resulting in 939,000 registration applications and 2 million vote-by-mail applications.

By the end of the 2020 election cycle, they had sent ballot applications to 15 million people in swing states - nearly one-third of which were returned.”

Influence Watch also notes that these organizations, “were widely criticized for mailing out partially pre-filled absentee ballots and voter registration forms in multiple states.”

The CCP was Involved with FTX from Start to Finish

Binance, a CCP China controlled crypto exchange, is the largest crypto exchange in the world. “As one of FTX's first investors, Binance knew the company well.” said CNBC. As Sun Tzu might have said “the best way to defeat a rival is to destroy it from within”, and that’s exactly what they did.

FTX executive Gary Wang, rumored to be a CCP agent, was placed inside to keep an eye on things and use the FTX laundry to be sure CCP and related officials received appropriate treatment. The CCP and those aligned with it (including major banks and government officials) control the world of crypto-currency. China controls over 50% of the mining and as recently as a year ago, four large Chinese companies owned more than 50% of the BTC. Crypto-currencies are the future and the CCP wants to be in the driver’s seat.

When Binance took a position in FTT (the in house loyalty coin of FTX) from the sell back of their FTX shares, they received approx. $2B of consideration consisting of BUSD (Binance’s USD stablecoin) and FTT. The split wasn’t disclosed, but the value of the FTT was likely $500m-$1B pre-crash; more importantly, Binance got a seat at the table to decide the fate of FTX. As FTX got in trouble and needed a suitor and fast, Binance was a logical option. Binance looked over the books, but passed in only a couple hours. CZ saw the trainwreck from the inside numbers and knew this was the time to plunge the sword through the heart of FTX, using the FTT he held, with this tweet:

That was the end of FTX in one tweet. Binance disposed of their main rival and solidified their position by losing less than $2B and probably half of that. That loss can be made up in trading profits in a few months. A no-brainer trade for CZ to solidify his position as the top exchange, without rival.

However, there was another party that would also benefit from the demise of FTX…

The Central Bank Digital Currency!

Already in testing for the wholesale “coin”, the crypto currency battlespace is now being prepared for launch. What better way to do battlespace prep for the new Fedcoin than to have a few large failures? Crypto currency “investors” will have taken a beating and everyone will be begging for strong regulations, to protect the widows and orphans. Remember, only the Central Bank coin is “safe and legal” and by the time the laws are crafted, any crypto coin remotely resembling money will be rendered illegal.

A few days after the FTX failure, Treasury Secretary Janet Yellen released the following statement on the recent crypto market developments:

"The recent failure of a major cryptocurrency exchange and the unfortunate impact that has resulted for holders and investors of crypto assets demonstrate the need for more effective oversight of cryptocurrency markets.”

Two more shoes remain to drop; As mentioned by Tweeter Satoshi Stacker: A hacker had access to the FTX private keys, admin access to the web site and IOS/Android admin. With that, all account data, including KYC (Govt Issued IDs) of all customers will be in the hands of someone. This is called “life insurance”. A few days after the Bahamian authorities impounded the company, Sam was spotted at a grocery in the Bahamas, texting on his phone without a care in the world, nor a police officer anywhere to be seen. This is what a person who tanked $16B and destroyed an exchange looks like when they have “life insurance”. No one dares touch them.

The next shoe to drop is Binance and Tether, which I expect will come under regulatory and hacking attack very soon. Fun times ahead!

Thank you Chris. It was my pleasure. Thank you for giving me the opportunity to speak some truth here, many of my comments get censored elsewhere. Thank you for your work and contribution to spreading information. It is tough to know these things but I wouldn't have it any other way. As the saying goes, knowledge is power; learn it, understand it, process it, support it, cry about it, laugh about it and then shout it out from the roof tops!! The more that we know the less they can do to us!!

Ellison and Fried are grotesque, misshapen cretins and proof that the Judeo-Masonic cabal love dark humor and in your face mockery.